Often in the trading industry, we hear about how trading is all about finding the ‘holy grail’ trading strategy. It seems that with all the focus on trading strategies. However, there are many other important concepts that traders should be aware of in order to be successful. One of the most misunderstood concepts is the Dunning-Kruger Effect. In this article, we will be looking at what it is – and why understanding it is essential for a trader.

The Dunning-Kruger Effect is an interesting phenomenon in which individuals with limited skills or knowledge mistakenly overestimate their abilities. People tend to have the most confidence when they know the least about a certain topic. This is due to a lack of awareness of their own inadequacies and an inability to recognise the complex nature of the task at hand. While this effect is often associated with incompetence, it can also be found in highly skilled individuals.

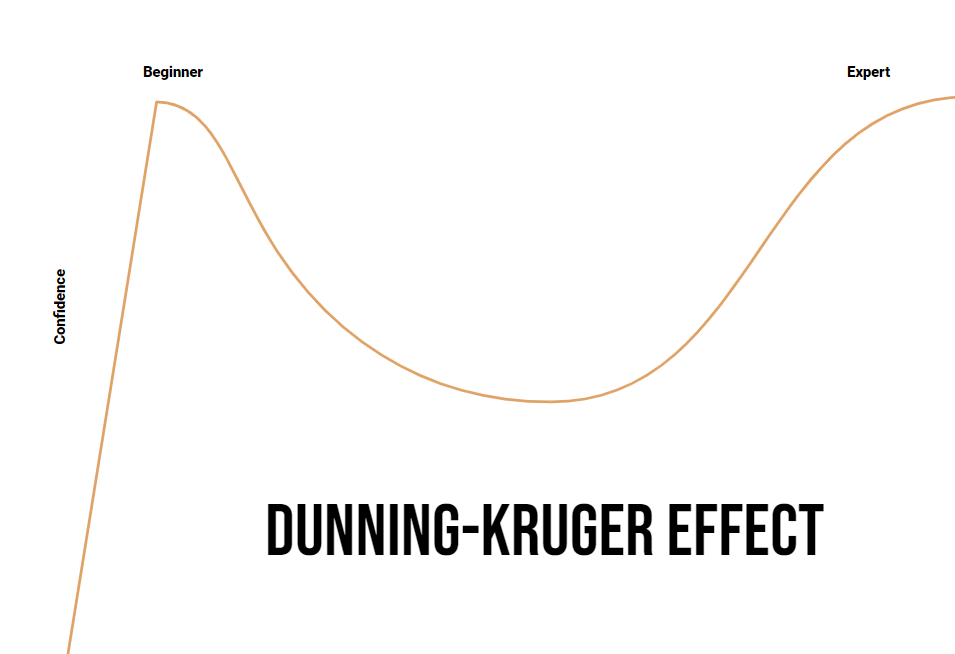

It was first identified in 1999 by psychologists David Dunning and Justin Kruger. They conducted a series of studies to explore the relationship between confidence and competence. They found that individuals who scored at the bottom of their tests were also the most confident in their answers, while those who scored at the top of the tests often underestimated their capabilities. The concept can be explained in the diagram below (as taken from our Get Funded Programme)

As people understand more about a topic or field of study, their confidence begins to decrease, Then as you become more and more familiar your confidence starts to pick back up as you progress towards an expert level of understanding. You may have noticed this in different people at different times. Someone may have high confidence in a topic they have no idea about. We all do it. There is nothing inherently wrong with it, but we want to be aware of it.

The Dunning-Kruger Effect can have a significant impact on decision-making. When individuals overestimate their abilities or knowledge, they are more likely to make poor decisions. This is because they lack the necessary information or skills to make informed choices. Additionally, they may be unable to accurately assess the risks associated with their decisions, leading to undesirable outcomes from their overconfidence. Individuals may be so sure of their abilities that they neglect to seek out further education. This is why sayings such as, ‘always be a student’, or ‘never stop learning’ prevent an individual from spiralling out of control in a downward trajectory.

It is important to always bear this in mind, not just with your own trading but also in every aspect of life. We want to be mindful of when we may be over or underestimating our own knowledge and ability in trading a particular strategy or style.

How this is relevant to trading?

The Dunning-Kruger Effect can have a major impact on our trading decisions within that strategy. When we overestimate our knowledge or skills, we may take on more risk than is appropriate. This could be through starting a new strategy or adding in a new concept into an existing model, such as an indicator. We see previous success stories with this new trading style and have may have high confidence that it will work. This may be followed by a series of early wins, further boosting our ego in the process. We may beat our chest, proud of what we have discovered. Then through a lack of understanding and the nature of the market as a whole, we incur a series of losses. This is an inevitable part of trading. Our confidence starts to drop as we realise that we have not discovered the ‘holy grail’, and now require further development during a drawdown period. It is at this moment we realise how we have not figured it all out and we have much to learn. The market humbles us.

Only by developing ourselves during this drawdown period can we escape our beginner phase, regaining our confidence through continued trial and error. We realise our mistakes, working relentlessly to perfect our craft. Momentum starts to rebuild, to the point where we are just as confident in our ability as we once were at the start of our journey. From only going through the trials and tribulations, do we have an expert-level understanding, with unwavering confidence that not even the market can undermine. This is the point in a trader’s journey where everything changes.

Understanding how to overcome the Dunning-Kruger effect is similar to taking advantage of the cycle of doom, also discussed in our Get Funded Programme. Only by sticking with the process can you breakthrough to the next level, which will also demand a different version of you.

But there are also huge positives to take from this. Firstly, only by understanding how the effect can you notice it in yourself and in others. It becomes easier to call a bluff when you fall victim to overestimating your own knowledge (and when others do also).

And then secondly, you can have faith that the learning period you may be in, is necessary. You must go through the stages, to come out an expert on the other side. If you are lacking confidence right now in your own trading, it is probably empowering to hear that if you continue to work relentlessly on your craft, you can develop your understanding to the point where you are as confident as you first were introduced into the trading industry.

Conclusion

By understanding our own limitations and being aware of the risks associated with our trading, we can make more informed decisions that are better suited to our individual skill level and experience. By using the Dunning-Kruger effect to avoid falling into the common traps that hold back the majority of unsuccessful traders, we can ourselves in the top percentage of traders in itself. We should always be seeking out new knowledge and continually strive to improve our skill-set in order to reduce the risk of making poor decisions – and increase our chances of making profits.