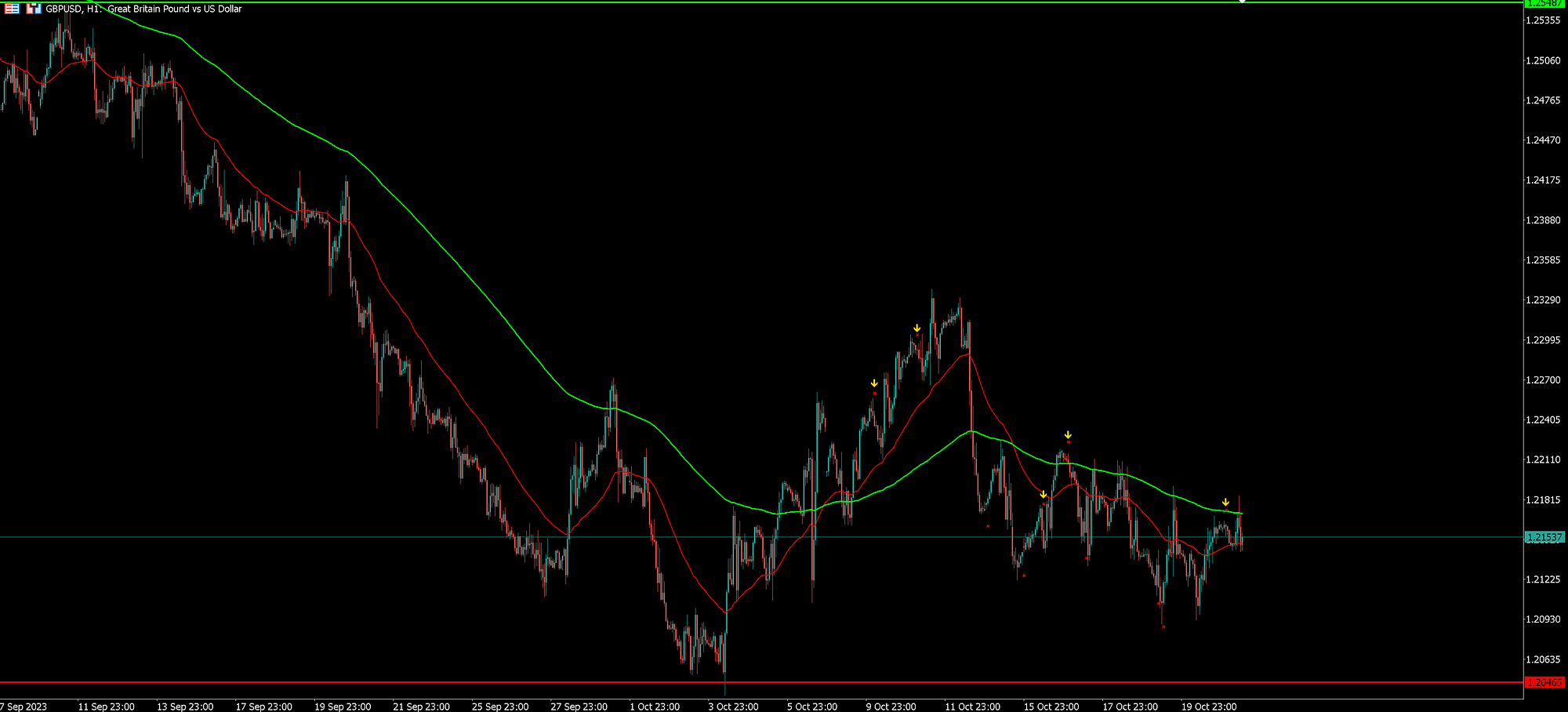

The foreign exchange market, with its complexity and fluidity, remains an intriguing landscape for investors and analysts alike. The GBP/USD currency pair, one of the most traded pairs globally, offers a compelling narrative as we venture further into 2023.

At first glance, forecasting the trajectory of GBP/USD over the coming six months appears to be a daunting task, especially with mixed signals emanating from both sides of the Atlantic.

The US Dollar’s Sturdy Ground The dollar, historically a bastion of safety during turbulent times, continues to hold its ground. Bolstered by a combination of rising interest rates and its position as a safe-haven currency, the USD is poised to remain formidable in the near term.

The British Pound’s Unyielding Stance Yet, the British pound doesn’t seem to be in a conceding mood either. The UK’s economy, displaying unexpected resilience amidst global economic challenges, provides a solid backdrop for sterling’s performance. Coupled with the Bank of England’s anticipated continuation of interest rate hikes, it’s no surprise that the pound retains its fighting spirit.

Considering these dynamics, the general consensus leans towards a moderate dip in the GBP/USD pair over the next half year. A median forecast circles around the 1.20 mark. However, the deviation in forecasts among analysts is noteworthy. Pessimistic views see the pound potentially diving to as low as 1.10, while optimists eye a surge towards the 1.30 threshold or even beyond.

Renowned Forecasts Chime In Distinguished financial institutions have weighed in on this discourse. Citibank, a titan in the banking sector, anticipates a bullish stance with a projection of 1.2600 for GBP/USD in the upcoming quarter. This optimistic view is further echoed by the Danske Research Team, predicting a bullish shift to 1.2300 in the same timeframe.

Factors to Watch As we move forward, several crucial elements will influence GBP/USD’s journey:

- Comparative growth trajectories of the US and UK economies.

- Rate hike strategies by the US Federal Reserve and the Bank of England.

- The ongoing conflict in Ukraine and its ripple effect on the world’s economic growth.

- The ever-evolving market sentiment and global risk appetite.

A Word of Caution In the intricate dance of currencies, where global events and economic policies often change the tune overnight, predictions come with their fair share of uncertainties. Investors are advised to tread cautiously, arming themselves with comprehensive research and professional financial counsel.

As the narrative unfolds, it’s clear that while the road ahead for GBP/USD might be peppered with challenges, it’s also ripe with opportunities for the discerning investor.

By Samuel Leach, Founder of Samuel and Co Trading