In this report, I look at the facts behind the extremely popular funded account challenges, showing you exactly what really goes on. Many naive individuals get caught in a game where the odds are stacked against them. They are in an uphill battle from the start due to the lack of understanding of how these paid challenges actually work and what you should be doing instead.

All content is for educational purposes only.

What are they?

From the start of the digital era, the financial markets have seen huge changes. One of the biggest changes to the retail trading industry is the rise of prop firms and paid-funded account challenges. The appeal of taking a trading challenge in the hopes of gaining a five or six-figure trading account for a couple of hundred pounds has taken the industry by storm. This exponential rise has almost become industry standard, with many individuals documenting and referring some of these companies to prone audiences.

Many beginner or unprofitable traders see these people promoting this content on their social media platforms and therefore, attempt to take the challenge in hopes of securing a large account early in their trading careers.

Now I want to make it clear that I understand why many people go for these challenges. It is the ultimate dangling of the carrot. I am not ‘bashing’ traditional prop firms / funded accounts and trading challenges – I am breaking down the paid challenges and the reality of what really goes on.

How do they work?

As they have been such a successful business model, there are now hundreds of these trading challenge companies offering their services. They offer a wide variety of options from different funding options and balances. Users often select their chosen balance, currency, and platform they wish to use. They then pay the fee, agree to the terms and start the challenge.

Due to the sheer number of companies offering these paid challenge accounts, the targets, leverage, and drawdown can vary – but generally, the user has to achieve an 8-10% profit within 30 days (often 20 trading days). This is commonly the first stage, with an additional phase, giving the trader the target of reproducing a profit of roughly 4-6% within an extended period of time. There are a variety of technical differences and considerations between firms, such as the ability to retake the challenge and refund terms but they generally form this structure.

Therefore, because of the specifics of retaken challenges, it can be difficult to break down the figures exactly – but just know that it gets ugly.

Why are they appealing?

The main reason why they are appealing to many traders is due to the ‘dangling of a carrot’. This is done through the appeared risk-to-reward in giving it a go. The upfront fee typically ranges anywhere between £300 – £1000 per challenge attempt. The possibility of taking a challenge and earning your way to an account balance of £10,000 – £200,000. This is a substantial difference, which is perceived to have a greater earning potential than trading a personal account with that couple hundred pounds. Many traders see others in the community posting on their social media about their experiences, which further encourages challenge participants. The problem with this is the lack of exposure surrounding the number of challenge attempts and therefore realised risk for reward.

To put it simply, you only ever hear from the few individuals who pass the challenge. You never tend to hear; the number of attempts they have made, the total cost they have spent, how much money they have made and continued to make thereafter finishing the challenge. It is important to note that a wide majority of individuals who pass these challenges, which is already the minority of people that attempt them, never actually go on to generate a profit and earn their money back from the upfront cost to participate.

This is not just hearsay. I have proof and I will break down exactly what is really going on.

The Real Economics

You can say that I am just a hater or that I don’t know what I’m talking about – but this isn’t my opinion. I am just showing you the facts of what really goes on. Now it is time to look into the numbers.

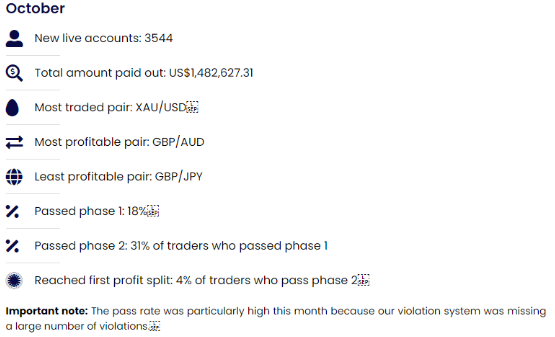

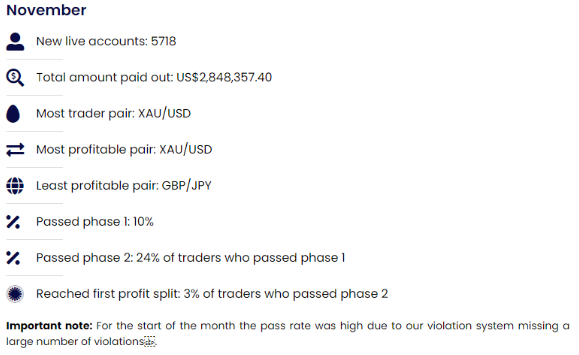

The following figures have been taken from one of the largest paid challenge account providers in the world. They have been publicly released for October and November 2021 and are available on their website; (links provided at the end of the report).

For both October and November being separate months, they are very similar in terms of the percentages.

You can take a look at them yourself using the link. They have stated on their website that ‘the stats are back’, but I have not been able to find any other data or releases.

There is a lot to break down. I will start with just how many traders actually pass.

Firstly, it’s worth noting that this company has continued to grow by a huge amount through 2021/22 so it is likely they have higher numbers in terms of the number of people starting the challenge. However, I will only focus on these two months of data. You can see clearly that out of the total number of attempts, the pass rate is very low.

If out of the 3,000 – 6,000 monthly attempts, 10-20% pass the first phase. Out of those individuals, 20-30% of those pass the second phase to get awarded a live account. From those who then get a live account, only 3-5% of those make it to a withdrawal – therefore receiving their refund from the upfront cost of taking the challenge.

The degree to which retake opportunities have interfered with these stats is undetermined. But you can see just how few people actually make money from the endeavour.

From those figures alone, October had 3,544 total attempts, but only 8 achieved a full refund and withdrawal. By the way, a withdrawal can be any positive amount on the account – even $1. Therefore, just because they made a withdrawal does necessarily mean they made a lot of money. November on the other hand saw 5,718 total attempts, but only 4 got the refund and withdrawal.

That means that the other 3,536 accounts for October and 5,714 for November lost their upfront fee. Their products range from around $100 – $1,000, with the most expensive at $2,450! So although the total payouts for both months totaled over $4 million, the total number of failed attempts at over 9,250, likely far exceeded this amount. Some of these paid demo challenge accounts are likely making between $5,000,000 – $15,000,000+ per month!

And if this is true for the source I have used – it is likely to assume this is the case for each competitor as they have such similar account settings – why would it be any different?

The largest and most popular challenge account provider announced that just under 1 million accounts were opened by users throughout 2021. However, they also state that they have over 10,000+ traders, representing around 1% of total participants who create an account. Therefore, it shows that although they have chosen not to release their stats, the numbers are likely to be very similar between competitors.

Conflict of Interest

You may say that it is in these companies’ benefit if you pass the challenge – due to the fact that they take a cut of your profit split. When you compare revenue streams, it is a fraction of their total income. This is only if the accounts are connected to a live account. Many of these challenge accounts are only demo accounts. Any time a withdrawal is made, they are taking funds from the pool of money from challenge attempts.

Therefore, their whole business model is angled around challenge participants and failed attempts. They are making millions from naive traders thinking that they can be one of those few who make money.

For October, just over 0.2% of paid challenge attempts resulted in a withdrawal (plus fee refund). In November, less than 0.1%! No matter how much content these companies put out on their social media positioning themselves as on your side, you have to remember that they make money from you losing and lose money when you withdraw. They by definition have a conflict of interest with you.

I want to make it clear that this is not the same for professional prop firms and may not be the case for this prop firm however, we are going off their own stats. This is the case where the ‘funded accounts’ are connected to demo accounts. This is not true amongst all challenge accounts, nor prop firms in general. Look behind the reasoning of what they are offering. Why are they offering this? What is their objective and does it align with my interests?

All of the above statements are for trading in general. Anyone trying to sell something or offer a product/service – you need to look beyond the pitch and understand the motives. Unfortunately, this is what the reality of the trading industry is and you have to learn to understand whether or not they have a conflict of interest against you.

Return on Investment

If you are still considering whether or not to give one of these challenge accounts a go, then be my guest. I am indifferent to it. All I am doing is presenting you with the facts – it is up to you what you do with the information. If you think a 0.1-0.3% success rate (based on the stats above to pass a challenge and withdraw) is a target you can hit then don’t let me stop you. Just know that, you are more likely to have superior odds in a casino.

Now I am not promoting gambling by any stretch of the imagination. We are traders, not gamblers. But when you consider that not even a casino has odds so stacked against you, it really puts it into perspective.

Let’s say hypothetically, you were at a casino and were in a scenario where you could bet anywhere between $100 – $1,000 for a 0.1-0.3% (less than 1%) of getting your money back plus an additional bonus, would you take the bet?

You probably wouldn’t, right? Even with the bonus being unknown, it probably isn’t a good decision on paper. Of course, you can get an account at the end of it, it still isn’t your money. You don’t get to keep that money. You have access to whatever the drawdown percentage is of the total balance. So if you have, say a $50,000 account, even after beating the odds and getting your original ‘investment’ back through a refund, you can only really trade 10% of it, which is the most common drawdown percentage.

It’s not, “pay an upfront cost to get $50,000”. It is to pay the upfront fee to get less than a 0.5% chance of getting your money back, to trade 10% ($5000) of it, and any profits are split back to you. Even if you have an amazing track record and do very well on the account, the return on investment is still not very high, especially when factoring in the risk you took to get in that position. Would it not be better to go with a prop firm, as opposed to a paid challenge account, pay an upfront fee, receive a live account and trade that? Or alternatively, open a personal account, deposit whatever that upfront fee was? The odds would be far more in your favour to generate a profit. Even if you had a few bad trades, you are probably going to have more in that account than you would have taken the challenge.

Why do so many fail?

Regardless of your opinions towards these paid challenge accounts, it is worth understanding why so many lose. If the stats are so slanted in one way, why is this?

I would say it comes down to a combination of reasons. The first derives from effective marketing campaigns for beginner traders. Many naive traders see others online posting their experiences which encourages others to take the challenge. With little to no experience, they take the challenge unaware of what they have really signed up for. But this goes deeper than just newbie traders. Many traders who have been involved in the markets for years also ‘give it a go’. They could be trying a new strategy they have seen online, which they think can be the solution to their problems.

It is not uncommon that a trader starts a challenge with a dedicated strategy. After that has failed, they go on to another system, and work on that a little until they feel ready to start another challenge. Maybe they almost pass, getting close to the finish line which gives them more encouragement for the next one. As they believe they are so close, they try again and again in this never-ending cycle.

I have spoken with people who have spent thousands on redoing challenges, always claiming they are “so close to passing this time”. We have spoken to people that have spent more than £10,000 attempting a challenge more than 10 times, all to be left with nothing. Yes some people pass the challenge eventually and they will shout from the rooftops but chances are it took them more than one attempt.

Therefore, it is a combination of effective marketing tactics and a lack of experience. If a trader is already unprofitable, which is the majority of traders, is it a good decision to pay for a challenge account that demands not just profitability but pretty much on-demand, expert-level trading in such a short space of time?

Risk Management

But it is not just a skill level. I am a firm believer that anyone can be a profitable trader. Some of the best traders I know didn’t have the best grades at school or the highest IQ. I wasn’t at the best schools getting high grades – but I dedicated myself to something, and continued to push myself to become successful. To become a profitable trader, it takes a lot of commitment, hard work (long hours) and patience. None of these things are what the challenge route promotes.

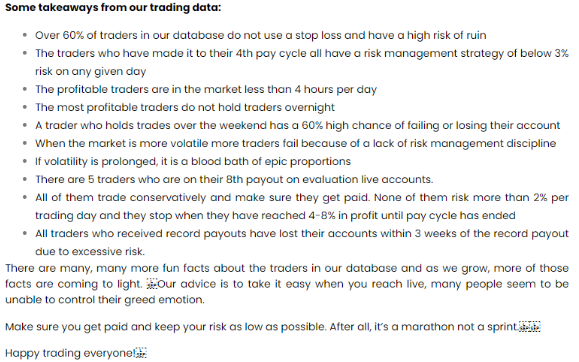

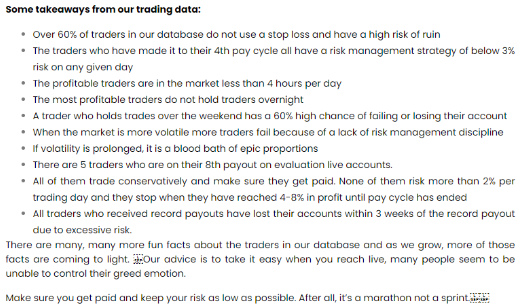

One of the main reasons I believe so many people fail these challenges is due to leverage and risk management. If you notice in the post, they heavily mentioned this:

I am still shocked at the transparency and choosing to make it public. But as you can see they refer to risk over and over. It seems that traders over-risk all the time. The one line that probably cements itself as probably the most horrific part about it, is that over 60% do not use a stop-loss. As a consistently profitable trader, this is mind-boggling!

It seems that traders are (understandably) trying to force passing the challenge by maintaining a high-risk level and being particularly aggressive in their trading. The idea of making lots of money probably takes over any logical thinking and often leads to blowing their account or breaking one of the challenge rules in place.

Remember that some of these points you can use to your advantage in your own trading. For example, “The most profitable traders are in the market less than 4 hours per day”, is a perfect summary exposing a common myth that more screen time = more money; trust me, it doesn’t.

Leverage

Another trading myth that I need to address is the idea of higher leverage = more money. It comes up all the time and it drives me crazy. I am not sure how or why people have got this voice in their head that tells them they need a high leverage amount to make money. As many of these challenge accounts use a high leverage of 100:1; another reason why so many traders fail these paid challenge accounts, I will break it down.

Giving challenge participants who already have a high probability of failing a high leverage of 100:1 only makes it more likely that traders do not pass the challenge. Although I say that not following a risk management procedure is the main reason why people fail the challenge, it is only facilitated by providing a high leverage. Without high leverage, traders would not be able to over-risk in the first place due to not having enough available margin. By offering over 100:1 leverage they are giving the participants the opportunity to over-risk and therefore risk losing the challenge.

Now, I am not completely against leverage. It is essential for trading. Leverage is used by a trader to magnify a position size. If it was not for leverage, most retail traders could not even trade, due to the upfront capital requirements to be involved in the markets. Therefore, leverage is offered by brokers to allow smaller clients the ability to borrow money to place positions in the markets. It is a tool to be used wisely.

The problem is that many naive traders believe that they need a very high leverage amount to make money. They do not. This is because, although the wins can be amplified to generate a higher profit from taking a greater position size, so can the losses. What ends up happening is a trader will commonly risk more than they arguably should and end up taking greater losses on the account. And this happens all the time, hence why it needs to be considered as one of the biggest reasons why traders fail these challenges so often. By the way, this is not my opinion, it is written by the company itself!

Just to put this into perspective for you, the Securities and Exchange Commission (SEC) released a report from 2011 covering a full analysis of retail trading. It is certainly an interesting read and has been linked at the bottom of this report. For now, here is a screenshot from the publication discussing the effects of leverage on retail trading:

This is why leverage has been capped in the UK, Europe, and Australia due to the number of losses people were taking on a higher leverage amount. The lowering of leverage has significantly reduced losses from retail clients. This is still as true in 2010 as it is today.

A counterargument to this could be that you are restricted to make money with lower leverage. You limit losses, which in fact, can make you more profitable. If you are a profitable trader, you don’t need leverage to make the difference. In my experience, it is always the traders who aren’t profitable that are the ones blaming low leverage for the reason they aren’t profitable. There is always one important rule in trading; If you can lose it, you can make it.

As you are taking a position based on one side of the market, if you take a loss, you could have made that amount if you took the other side instead. Therefore, anyone who can lose a lot of money could have made that amount. It always seems to be that the leverage is the issue to the upside but forgotten about when it comes to downside risk. If someone can lose say $5,000 on what is perceived as ‘lower leverage’, they could have made that on that same leverage. And now to back up my point, we have the SEC also stating the same thing – that lower leverage resulted in lower losses for the retail trader!

Drawdown

The main issue with this higher leverage of 100:1 is the drawdown percentage. As mentioned, although you may earn a five or six-figure account from passing the challenge, the reality is that you only end up being able to use around 10% of that. Therefore, a $50,000 account only allows you to trade around $5,000 of risk before the account is taken away from you. This is no matter how well you do as a trader, you would lose the account and have to restart the challenge again if you wanted another account. This firstly indicates again that the main focus of the business model is around failed attempts, not keeping consistently profitable traders. But also secondly, they do not have a huge buffer to work with.

A 10% drawdown, even with solid risk management and a good trading system can be easily hit at any time in a trader’s journey. It happens to all of us. I have recently had a 10% drawdown which I am happy to admit, showing traders that they aren’t always going to be in the green as such. Most, if not all traders, no matter their trading strategy will incur a 10% drawdown at some stage, no matter their win ratio and, or profit factor, (and I have around an 80% win ratio!).

It happens to all of us and is a part of the process. Sometimes you just have a bad month or two and before you know it you can be in a drawdown and have lost the account. This is probably the reason that there are only 5 traders on 8 consecutive withdrawals. The problem is not drawdown, it is the fact you cannot trade your way back out of the situation, which is one of the most important stages in a trader’s journey. From personal experience, the ability to trade yourself out of a drawdown gives you more confidence than just having instant success. You know that anytime you incur a few losses, you have been in a worse situation and got yourself out of it. Whereas these paid funded accounts you lose the account and that’s it. You cannot work on it, getting feedback and support to guide you through the process back into profitability. If you are paying a lot of money, do you want to put yourself in a position to lose it so easily?

Alternative Funding

If we know that most traders fail these paid trading challenges due to a combination of a lack of education, high leverage, and a limited drawdown allowance then what is the alternative?

First things first, if you are looking for a prop firm to acquire capital to trade on behalf of, you need to find a reputable company in the space that has a proven track record. Just because a company has good reviews does not mean they have a proven track record of profitable traders. You need to try to identify what the performance of the traders is like within the company to figure out where you can get your edge.

For example, at Samuel & Co Trading 21% of our live traders are currently in profit on their account and a further 18% submitted a withdrawal request this month (made at least 4% profit in the month) so a total of nearly 40% profitable traders. Because we support our traders through trading reviews, mindset sessions, and other company events, our trading performance is in the upper tier of the industry. We average around 20% of traders each month who make a minimum of a 4% withdrawal on accounts ranging from $25,000 to $100,000, with some traders hitting 12%. Over 10% of our traders have held accounts with us for 2 years or more, and over 30% of our current traders have held an account for at least 1 year. This demonstrates the longevity of our trading accounts compared to the challenge accounts.

When you compare this to the stats of a company in the paid trading challenge space you can see just how big of a gap that is. You are picking an environment in which you can develop in, connecting with other like-minded traders at our company events, trading meetups, or even booking in at our live trading floor!

The reason we have stats like these is due to our ongoing support and company perks. We work with our traders as a pose against them. It is in our benefit to work with our traders and turn them from unprofitable/breakeven traders to consistently profitable ones. Another way we do this is by allowing a 30% drawdown allowance for our live traders. This huge buffer allows a trader to identify any particular issues they may have through our coaching program to move towards profitability.

Therefore, no matter what stage you are at in your trading journey, (like so many others have), you may find it far more beneficial to join a company like Samuel & Co Trading. You can take the time to learn our trading education, ask questions to our coaches on how to improve your performance and then go live on to your own funded account. If you follow our risk management rules and attend our reviews, we will put you on a 6 step progression plan allowing you to scale from a $25,000 account all the way up to $100,000!

So you are not just getting a funded account by joining the program, but also putting yourself in a position to scale your capital base, whilst being in an environment with other like-minded traders – allowing you to become the best possible trader you can be.

Trading Challenges

I also want to make it clear that I am not against trading challenges. I have taken part in a variety of trading challenges, even hosting my own (free not paid). Trading challenges can be a fun way to show what you have got – giving the possibility for talented traders to earn a cash prize or a funded account of their own. My only question is why would a trader take a paid challenge when they can take part in one for free?

Samuel & Co Trading hosts free trading challenges for a limited time only, to give back to our community and support talented traders. We will post on our social media and via email when we are launching a new trading challenge so make sure you are subscribed to the Samuel & Co Trading Newsletter on our website.

Conclusion

To conclude, I am not just hating on the paid trading challenges. I have only broken down the stats that have been published by one of the largest companies in this space. I knew that the stats were heavily in the favour of these companies, not the trader, just from how many of these companies have been popping up – I just never realised they were quite so horrific.

It is when you put it all together, you can see that giving retail traders the ability to risk any amount they want, in conditions where they are trying to demand trading success in a short period of time with a financial risk on the line through an upfront cost, ends up with the overwhelming majority of participants not just failing to pass the challenge but also to keep an account. I believe there are many other alternatives that are not just more beneficial from a short-term financial point of view, but also from a longer-term sustainability point of view.